excise tax ma calculator

Massachusetts imposes a corporate excise tax on certain businesses. The following models illustrate calculations of amounts due for representative automobiles.

States With The Highest Lowest Tax Rates

All corporations that expect to pay more than 1000 for the corporate excise tax have to make estimated tax payments to Massachusetts.

. The following models illustrate calculations of amounts due for representative automobiles. Consideration between 100 and 10000 is not subject to excise tax. Your household income location filing status and number of personal exemptions.

Payment is due 30 days from the date. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor. The motor vehicle excise.

Enter your vehicle cost. - NO COMMA For. Massachusetts corporate excise tax is calculated by adding two different measures of tax depending on whether the corporation is a tangible or an intangible property.

Present market value price paid or condition are not considered for excise tax purposes. It needs to pay in 4 installments the. Municipal Office Building 66 Central Square Bridgewater MA 02324 Phone.

The states room occupancy excise tax rate is 57. The excise rate is 25 per 1000 of your vehicles value. The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise.

Excise tax bills are due annually for every vehicle owned and registered in Massachusetts. Massachusetts Property and Excise Taxes. For any consideration over 10000 please use the Excise Calculator below to determine the required excise tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. We would like to show you a description here but the site wont allow us. Model 1 Model 1 assumes a motor vehicle a purchased in the.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Note that while the statute provides for a 5 rate an uncodified surtax adds 7 to that rate. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

The motor vehicle excise. If you dont make your payment within 30 days of the date the City issued the excise. Excise tax bills are prepared by the Registry of.

It is an assessment in lieu of a personal property tax. Model 1 Model 1 assumes a motor vehicle a purchased in the. Value for Excise x Rate 25 or 0025 Excise Amount.

Google rolls out pay calculator. Town of Bridgewater MA. The excise tax is 228 per 500.

Consideration of Deed Total Excise Amount. Tree of savior exp calculator. Corporate excise can apply to both domestic and foreign corporations.

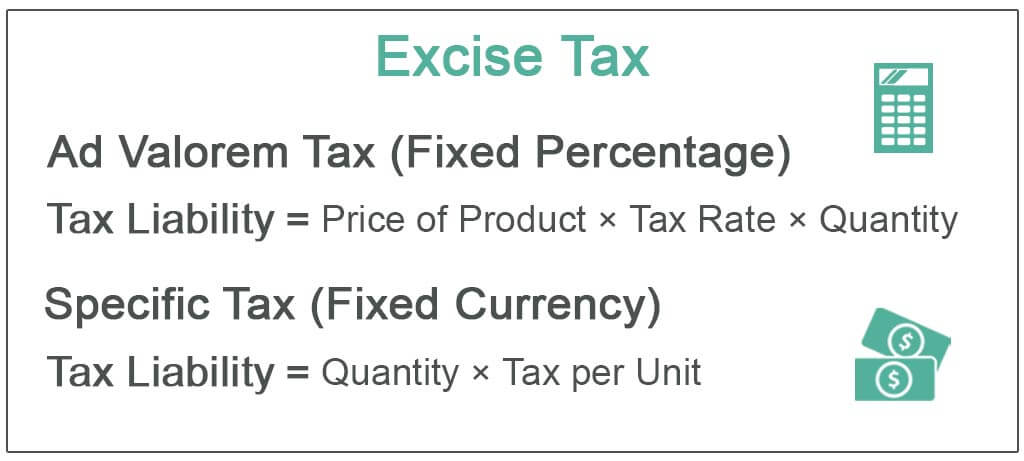

The excise tax law establishes its own formula for valuation. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Total tax to be collected.

How often do you pay excise tax in MA.

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

Rhode Island Income Tax Calculator Smartasset

How High Are Recreational Marijuana Taxes In Your State 2019

Fuel Taxes In The United States Wikipedia

Welcome To The City Of Bangor Maine Excise Tax Calculator

Excise Tax Definition Types Calculation Examples

Ma Vehicle Excise Tax Johnson And Rohan Insurance

Marijuana Tax Rates A State By State Guide Leafly

Excise Tax Frequently Asked Questions North Andover News

How To Figure Sales Tax For A Car In Massachusetts Sapling

I Have To Pay Tax On Selling My House Massachusetts Deed Stamps Property Transfer Tax Massachusetts Real Estate Law Blog

Somerville Excise Tax Deadline Approaching Somerville Ma Patch

Massachusetts Legislature Passes Legislation Enacting Work Around To Federal 10 000 Salt Deduction Limitation But Governor Baker Sends It Back With Amendment Don T Tax Yourself

Liquor Taxes How High Are Distilled Spirits Taxes In Your State